FarmBooks Financial Statements

The farm/non-farm financial statements are the reports used to determine the profitability of the business, evaluate new investments, or analyze changes in equity.

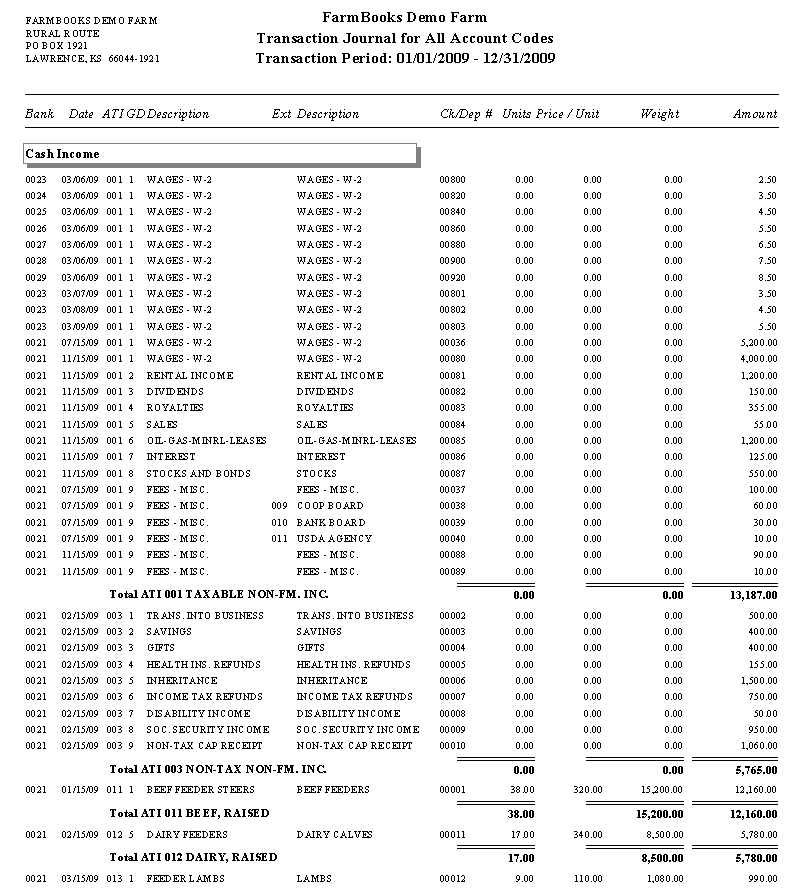

Transaction Journal

The Transaction Journal lists all entries grouped income, expense, wage withholdings and losses, loans, and accounts receivable. Every transaction is listed the way it was entered.

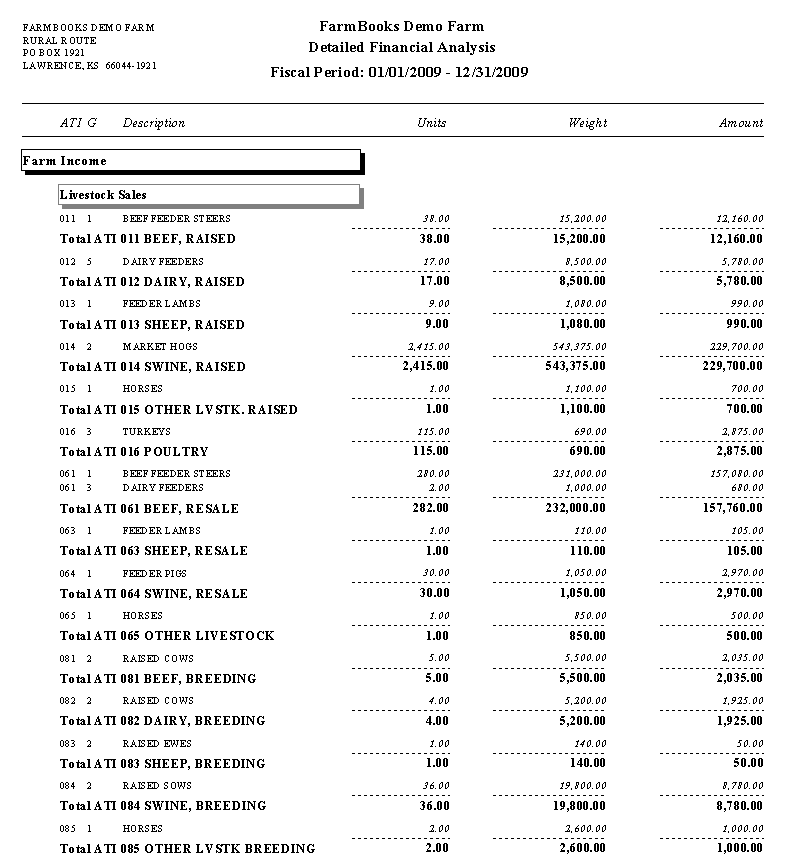

Detailed Financial Analysis

The Detailed Financial Analysis report lists farm and non-farm income and expenses by ATI code. It includes year-to-date values for units, weight, and amount; and calculates net cash flow for both farm and non-farm.

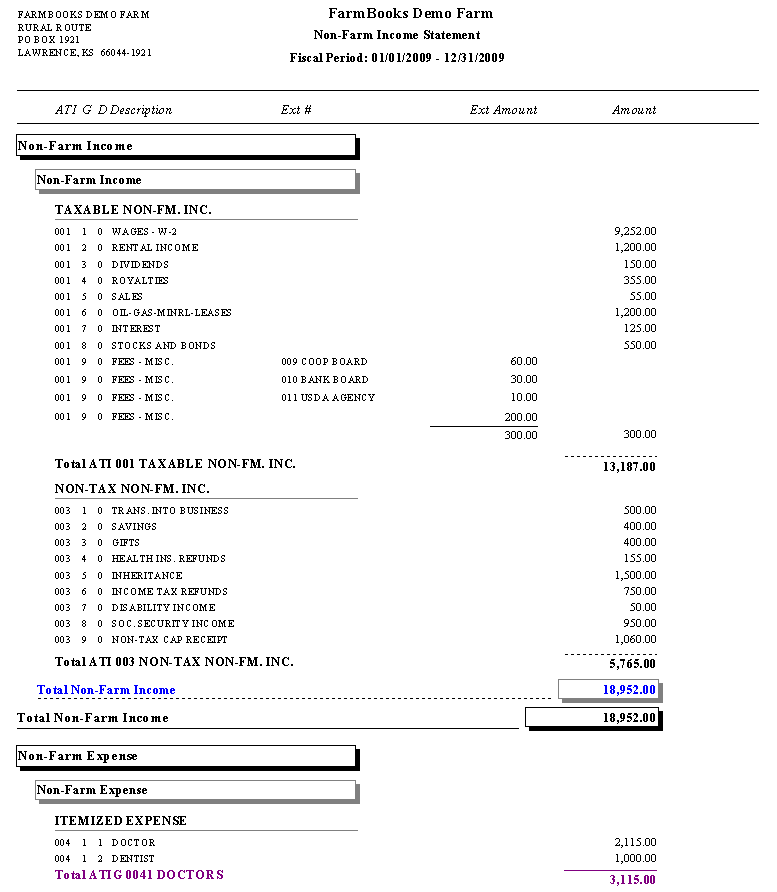

Non-Farm Income Statement

The Non-Farm Income Statement lists the year-to-date dollar amount for each non-farm income and expense account code. It summarizes non-farm income, itemized expenses, family living expenses and calculates net non-farm inflow.

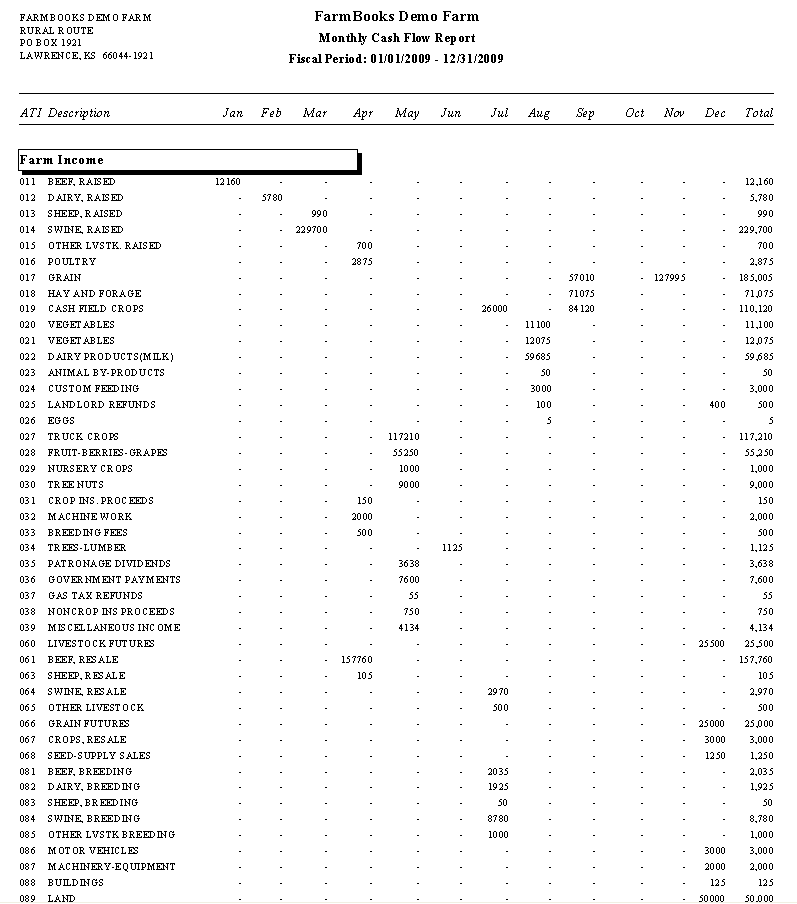

Monthly Cash Flow Report

The Monthly Cash Flow report lists the sources and uses of cash by income and expense categories. It shows the money flow and includes farm and non-farm income and expense totals by ATI account code, along with loans and accounts receivables.

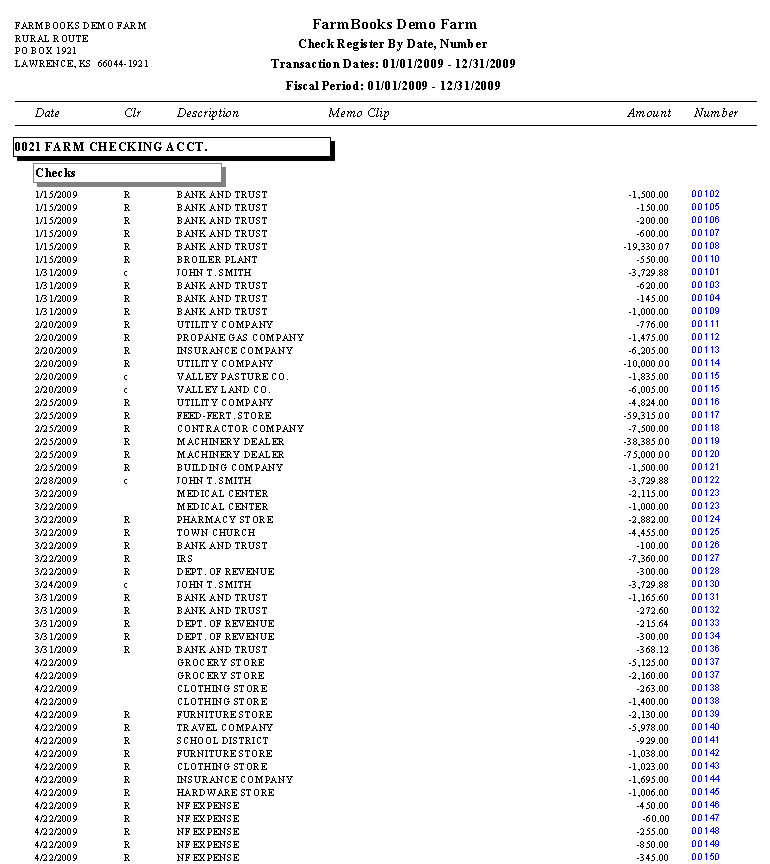

Check Register

The Check Register is a detailed listing of all checks, deposits, and transfers for a range of dates. The report calculates the bank balance for the specified period. Options for the report are sorted by check number or sorted by date and then check number.

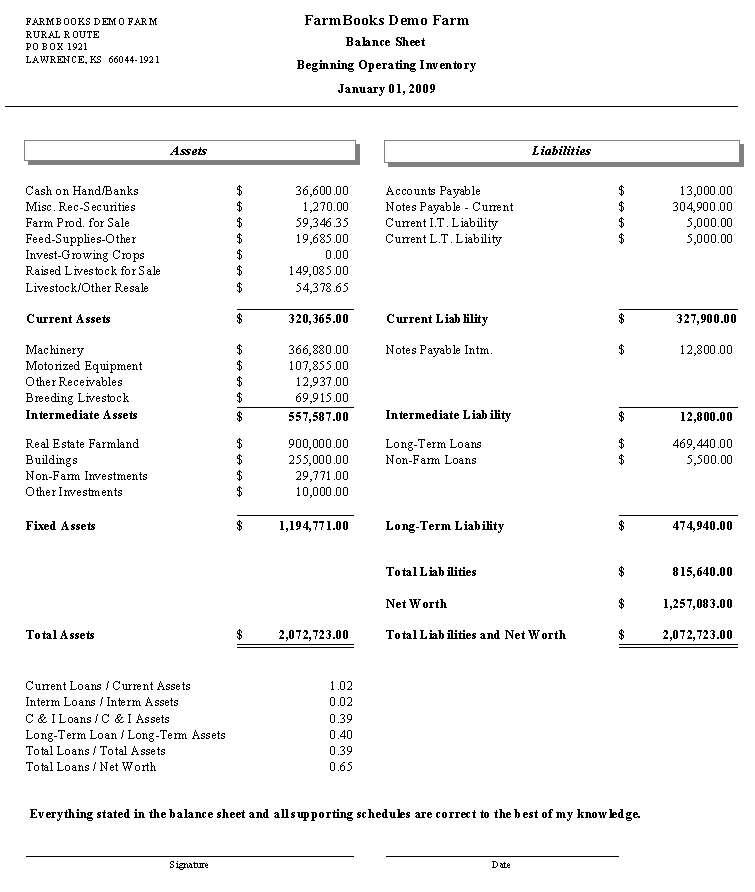

Balance Sheet

The Balance Sheet is a statement of the financial condition of the business at a specific time and contains detailed information on assets and liabilities. Supporting schedules (based on either operating or market values) can be printed for year beginning or end.

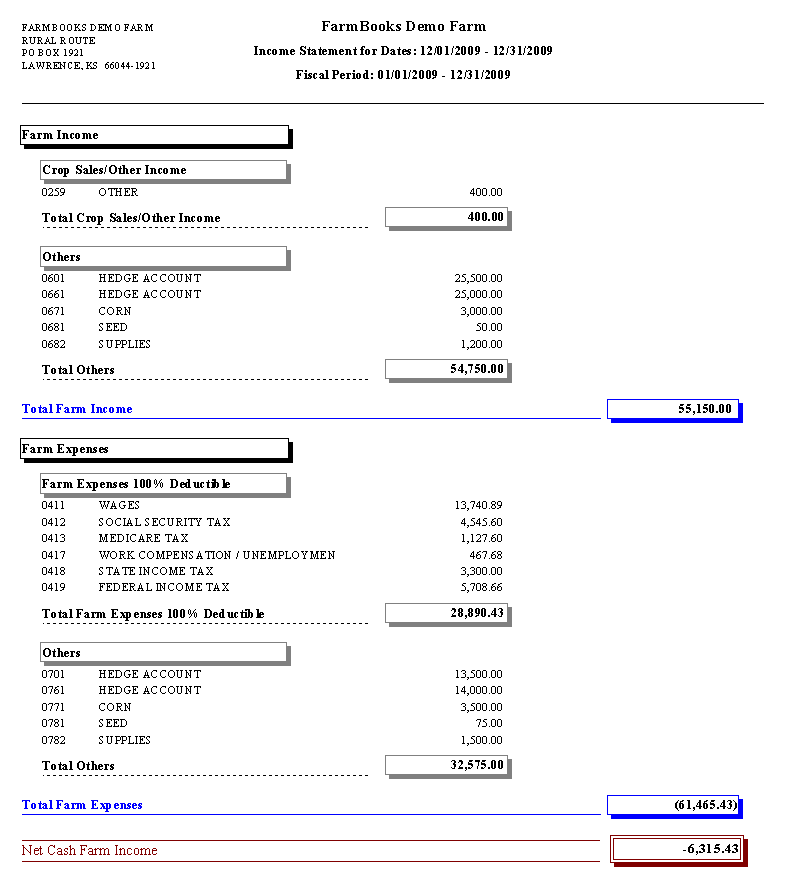

Income Statement

The Income Statement (aka Profit and Loss Statement) measures the success of the business for a period of time. It includes cash farm business receipts and expenses, depreciation expense, and the change in operating inventory value.

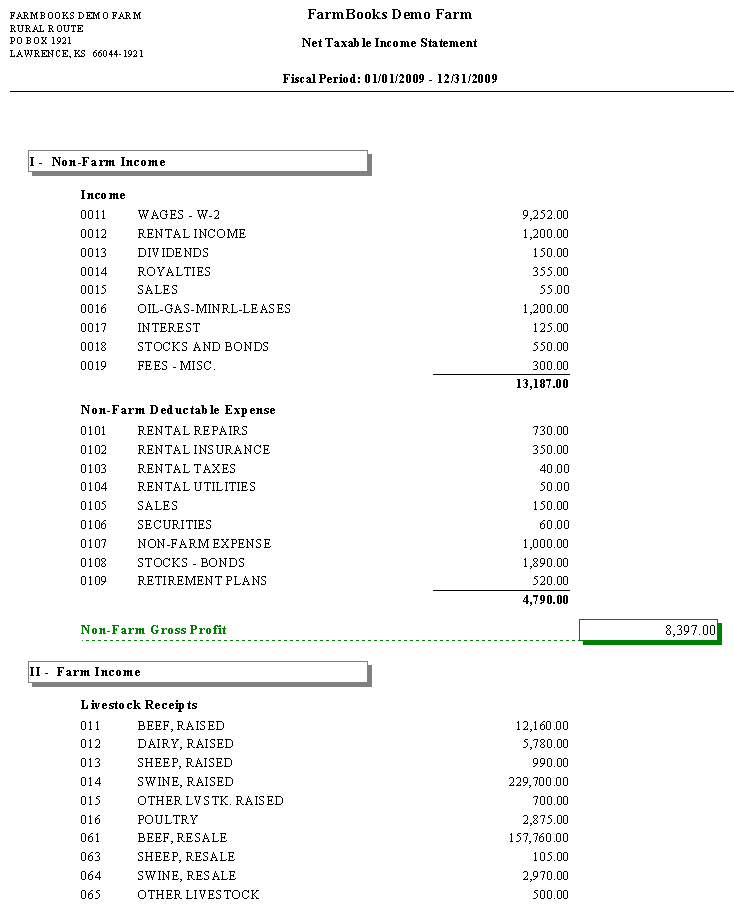

Net Taxable Income Statement

The Net Taxable Income Statement computes farm and non-farm taxable income, as well as net income per book. It includes farm income and expenses values incorporated in the preliminary Schedule F report as well as non-farm income and business expenses.

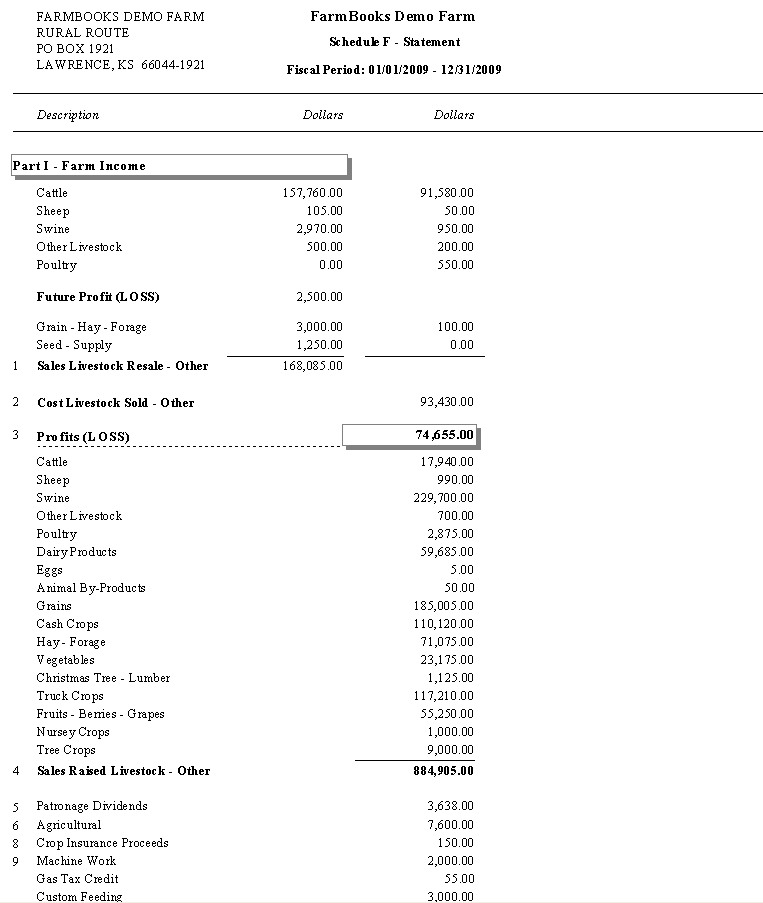

Schedule F

The Schedule F report lists all farm income and expense, except for breeding livestock and capital asset items. A depreciation charge is obtained from the Planning option.

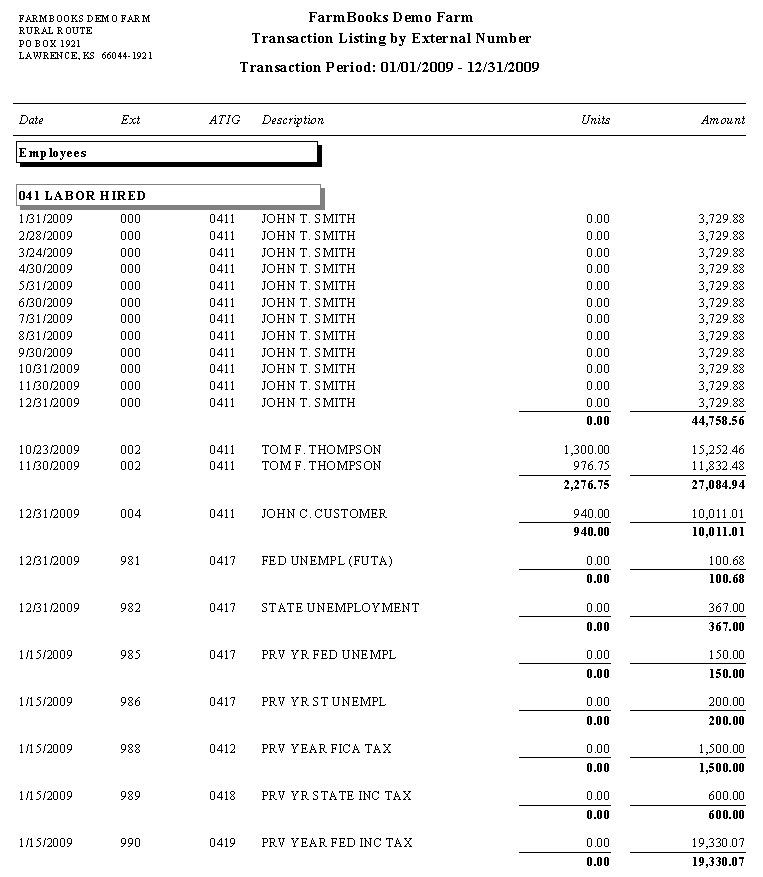

Transaction Listing by External Number

The Transaction Listing by External Number report is similar to the Transaction Journal except only entries with an external code are listed. It can also display a selected external number.

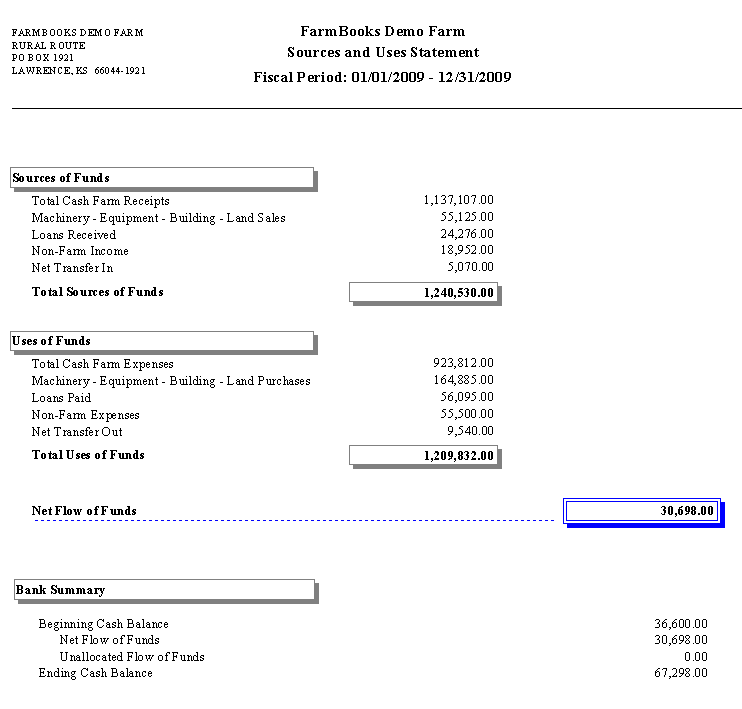

Sources and Uses Statement

The Sources and Uses Statement lists the sources and uses of funds and computes the net flow of funds and ending bank balances. It uses only broad categories for sources and uses of funds, and provides only year-to-date values.

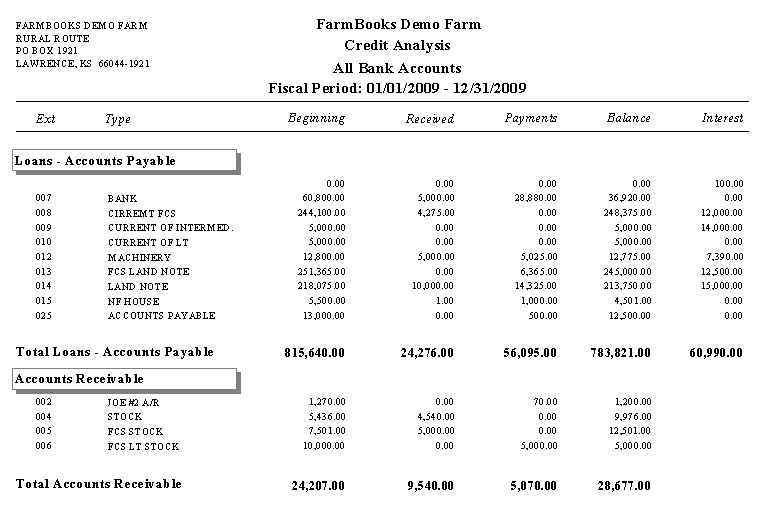

Credit Analysis

The Credit Analysis report displays detailed information for Loans and Accounts Receivable. It lists beginning balances, loans or accounts receivable received, payments made, and calculates the year-to-date ending balance.

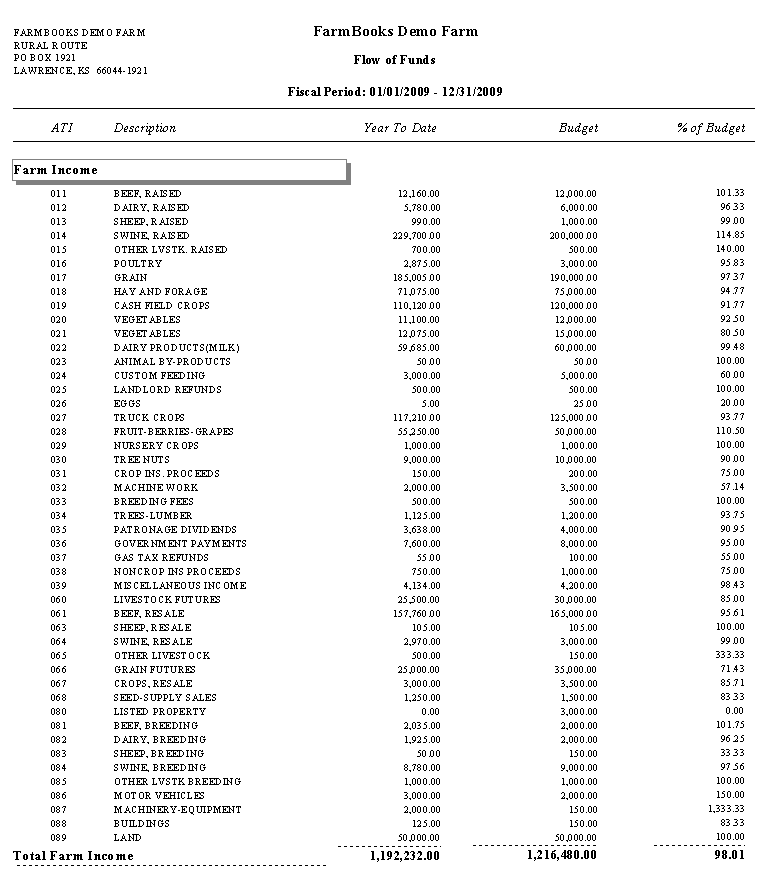

Flow of Funds

The Flow of Funds report is similar to the Monthly Cash Flow report but only lists year-to-date values. It compares the budget values to year-to-date actual values and computes the percent of budget used. It only computes properly if budget values for each account code have been entered in the Planning option.

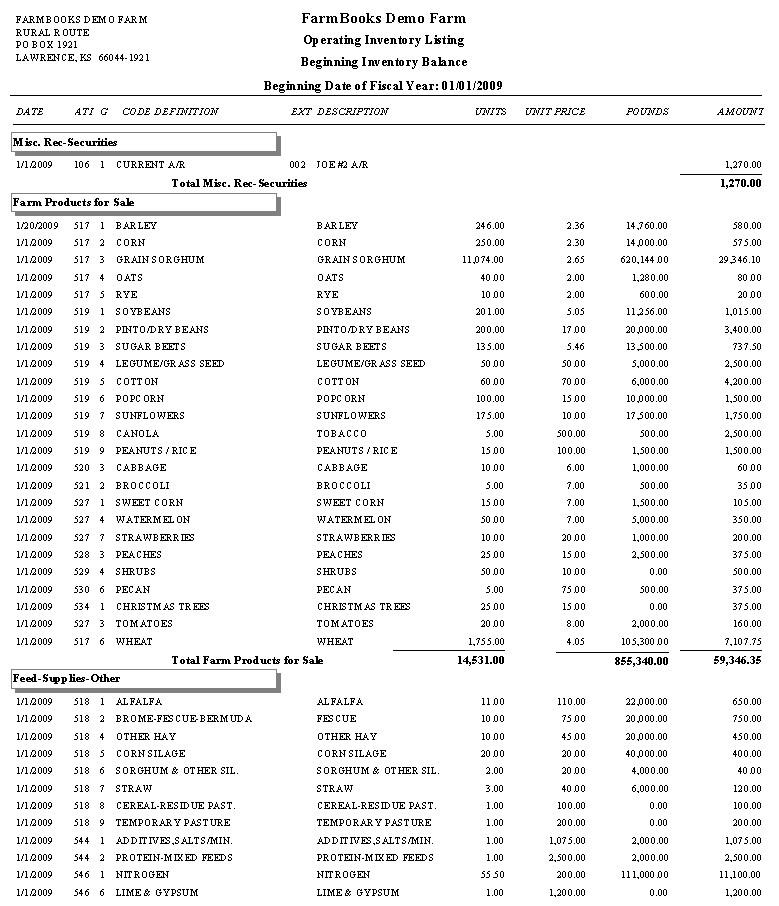

Inventory Detail Listing

The Inventory Detail Listing report is a complete listing of all beginning and ending inventory transactions. The transactions are grouped into major income and expense categories. The report is similar to the balance sheet supporting schedules and will list either operating or market value inventory transactions.

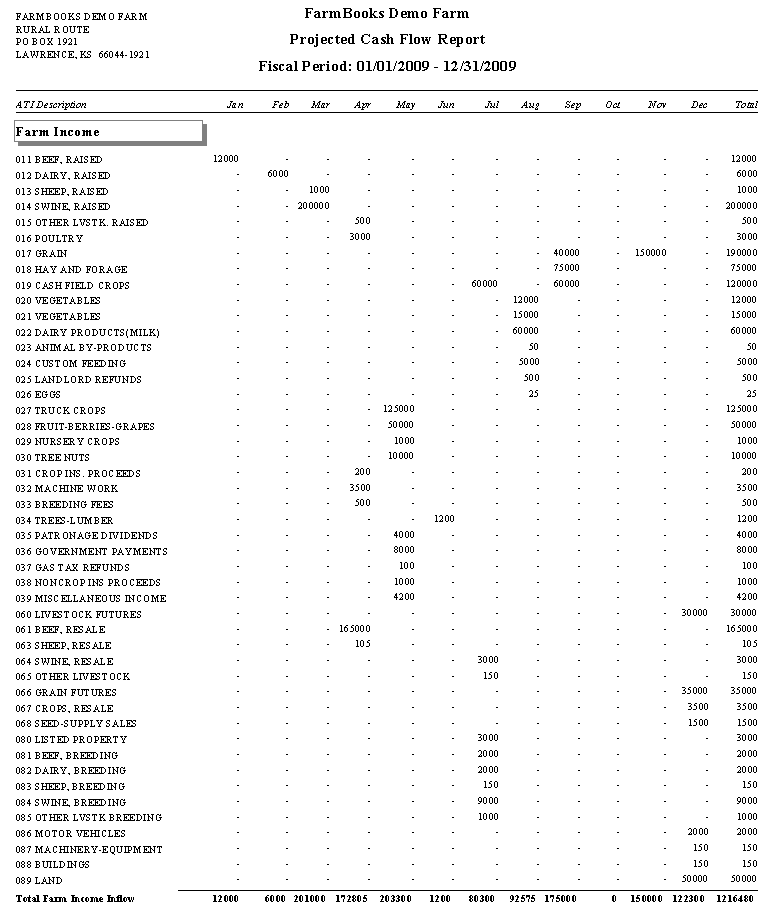

Projected Cash Flow

The Projected Cash Flow report is identical to the Monthly Cash Flow report, except the budget values recorded in the Planning option are used instead of actual values. This report is used to compare actual income and expenses to a planned budget.