Update Tax Table

Each year the tax rates change based on federal and state legislation and it is necessary to update the tax table in order to calculate the correct payroll withholdings for the new calendar year. The tax table update is a two step process. The new tax table must be obtained and then applied to your farm database. The process will preserve any percentages that you entered for farm utility or farm automobile percentages. If your farm number is for a non-Kansas state, then your state rates for the current year will be saved and restored for the new tax year. Should your state rates have changed for the new tax year, then you will need to edit the state rates (married and single) manually by clicking on Setup: Tax Table after the Update Tax Table is applied to your farm database.

- Backup your database by clicking File: Backup and completing the steps of the backup.

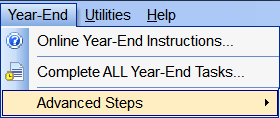

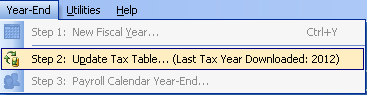

- Click on Year-End: Advance Steps

and then select Step 2: Update Tax Table from the Advanced Steps fly-out menu.

and then select Step 2: Update Tax Table from the Advanced Steps fly-out menu.

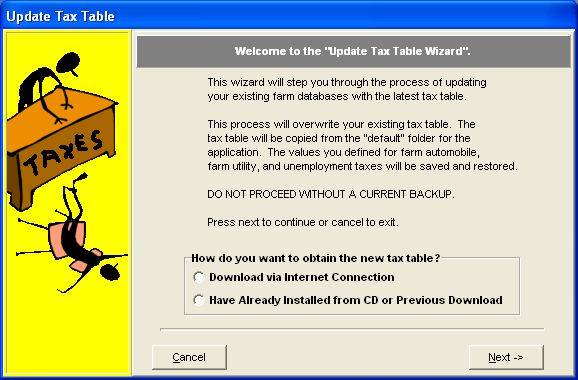

- The Update Tax Table Wizard will open. Select Download via Internet Connection or Previous Download (if obtained from farmbooksaccounting.com) and click Next.

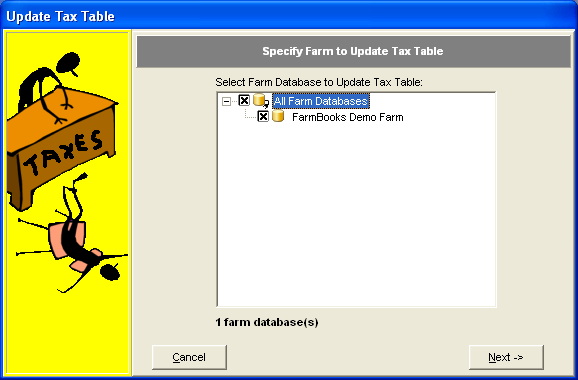

- Select a farm by clicking the check box, and then click Next to update the tax table.

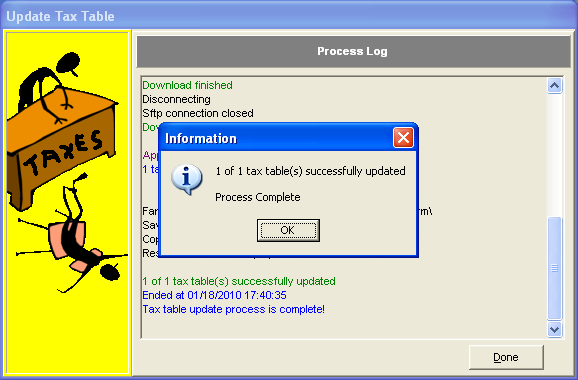

- Click OK to close the information box, then click Done to complete the update.