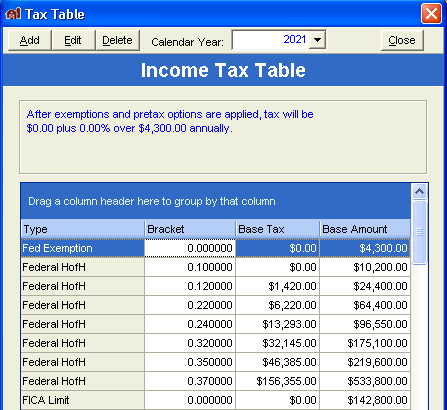

Tax Table

The tax table is used to calculate federal and state income tax withholding for payroll. The tax brackets can be edited whenever these amounts change. This table also contains the following percentages:

- Farm Auto

- Farm Utility

- FUTA

- Kansas Employer Contribution

- FICA Upper Limit

- S.S. Report

- Medicare Report

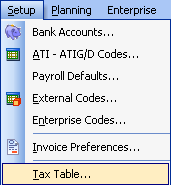

To access the Tax Table:

- Click on Setup: Tax Table

- Enter farm auto and farm utility percentages in this table. See preferences for instructions on how to automatically split utility and auto expenses between farm and non-farm when entering checks.

- Farm Auto % – The entered amount for the ATI code 008 (undivided auto expense), which will be used for the non-farm expense. The remaining dollars will be allocated to farm expense at the percentage specified.

- Farm Utility % – The entered amount for the ATI code 007 (undivided Utilities), which will be used for the non-farm expense. The remaining dollars will be allocated to farm expense at the percentage specified.

Call Sanders Software Consulting, Inc. Support at (785) 865-5111 before making changes to the other tax categories.