Recording Payroll Federal Tax Deposits

How do I determine the amount of federal taxes owed for my employees?

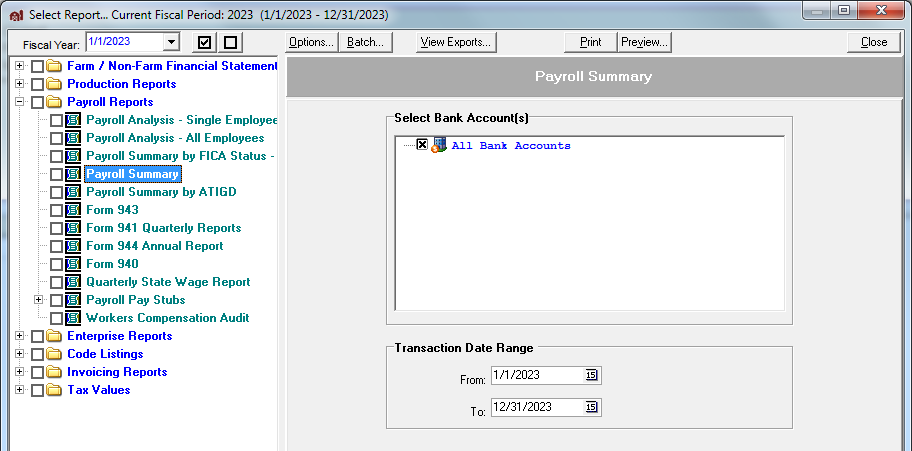

Run the Payroll Summary report to obtain the current amount owed for FICA (Social Security and Medicare) and Federal Taxes. Click on Report: Reports to open the Reports window.

Click on the Payroll Reports folder and select the Payroll Summary report. Select your bank account and click either the Print or Preview button to view the report.

The FICA amount reflects both the employer and employee portion of taxes due minus any payments in the column “Amount to be Deposited”. The report shows a total line “Federal Tax Deposit Required” amount for FICA and Federal amounts summarized. It is important that payments in the current year for the previous year are recorded correctly in order for the report to be accurate.

How do I apply a federal payroll tax deposit in the current year for the previous year?

Payroll withholding ATIG codes are 941x where the x value for the G-Code is 2=Social Security, 3=Medicare, 8=State, and 9=Federal. To make a tax deposit for any of the withholding use the corresponding A-Code of 0 or 041y where the y value equals the x value above for the G-Code. To designate the payment as the previous year use an External Code in the range 985 to 990. For instance, pay the federal tax deposit for the previous year use ATIG=0419 with an external code of 990 for “PRV YEAR FED INC TAX”. Run the Payroll Summary report and you will notice that the column “Amount Paid” does not reflect the payment for the previous year which allows the “Amount to be Deposited” column to be accurate for the current year.

How do I apply a federal payroll tax deposit in the current year?

Use the same ATIG codes 041x where the x value for the G-Code is 2 through 9 as described in the previous question related to recording a tax deposit in the current year for the previous year. However, use an external code in the range 991 to 999 to denote a current year deposit. Run the Payroll Summary report and you will notice that the column “Amount to be Deposited” will have the amount for Social Security, Medicare, and Federal Taxes. The FICA (Social Security and Medicare) amount reflects both the employer and employee portion of taxes due minus any payments. Also, the report shows a total line “Federal Tax Deposit Required” amount for FICA and Federal amounts.