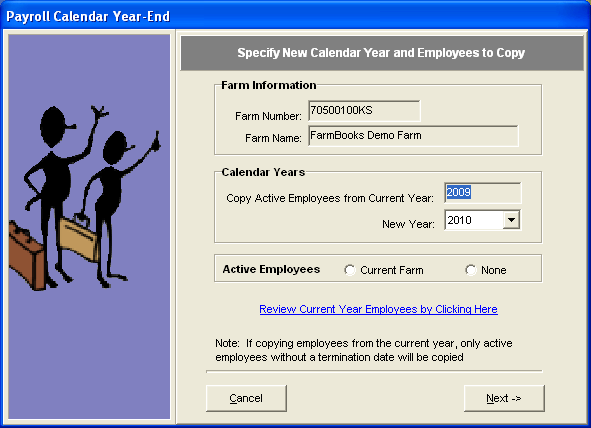

Payroll Calendar Year-End

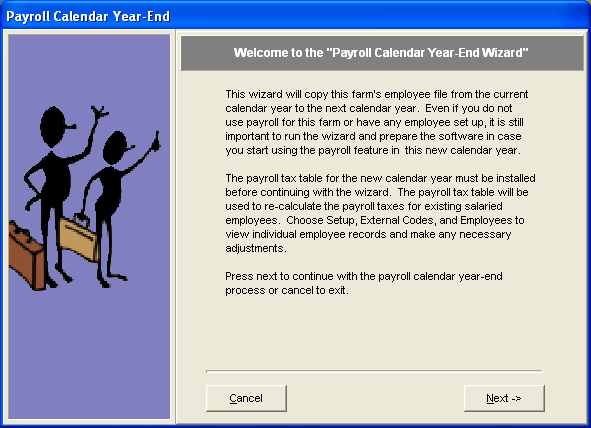

This process sets up the calendar year so that employees may be created or maintained. You may copy employees from the current calendar year to the new calendar year if desired.

NOTE: There are two prerequisites that must be completed before the new payroll calendar year may be created. You must have installed the upcoming new calendar year tax table update and have created the new fiscal year. See list of steps listed below for Year-End processing.

If you do not like the outcome of the payroll calendar year-end process and wish to re-run it with different options, then you may re-run this process before any paychecks are entered. This will delete all the setup data created for the new calendar year specified.

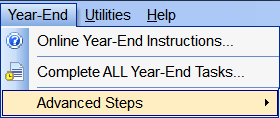

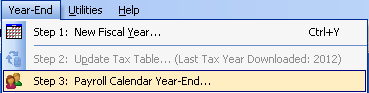

- Click on Year-End: Advance Steps

and then select Step 3: Payroll Calendar Year-End from the Advanced Steps fly-out menu.

and then select Step 3: Payroll Calendar Year-End from the Advanced Steps fly-out menu.

- When the Payroll Calendar Year-End Wizard opens, click Next.

- If you want to copy employees, you must have the current fiscal year open. Only active employees without a termination date will be copied. Once completed, click Next.

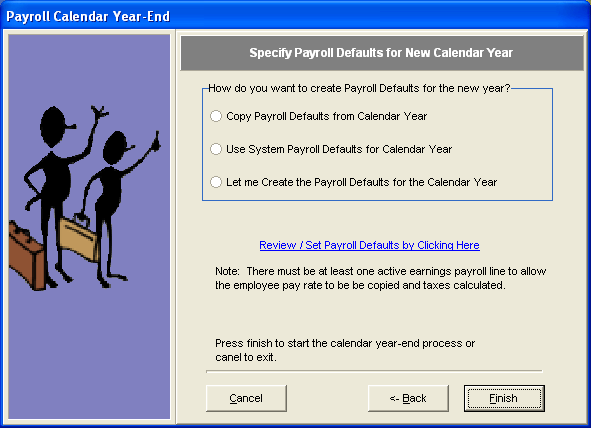

- Specify Payroll Defaults for New Calendar Year – You have three options to choose from:

- Copy payroll defaults from a prior year

- Use the system defaults (you may indicate which deductions are pre-tax)

- Manually enter your default codes for the new calendar year.

Click Finish to complete process.